Condo Insurance in and around Los Angeles

Los Angeles! Look no further for condo insurance

Condo insurance that helps you check all the boxes

Condo Sweet Condo Starts With State Farm

No matter your level of preparedness, the unexpected can happen. So be the condo owner who is prepared with quality insurance which may be able to help in the event of damage from theft, weight of ice, or freezing pipes.

Los Angeles! Look no further for condo insurance

Condo insurance that helps you check all the boxes

Why Condo Owners In Los Angeles Choose State Farm

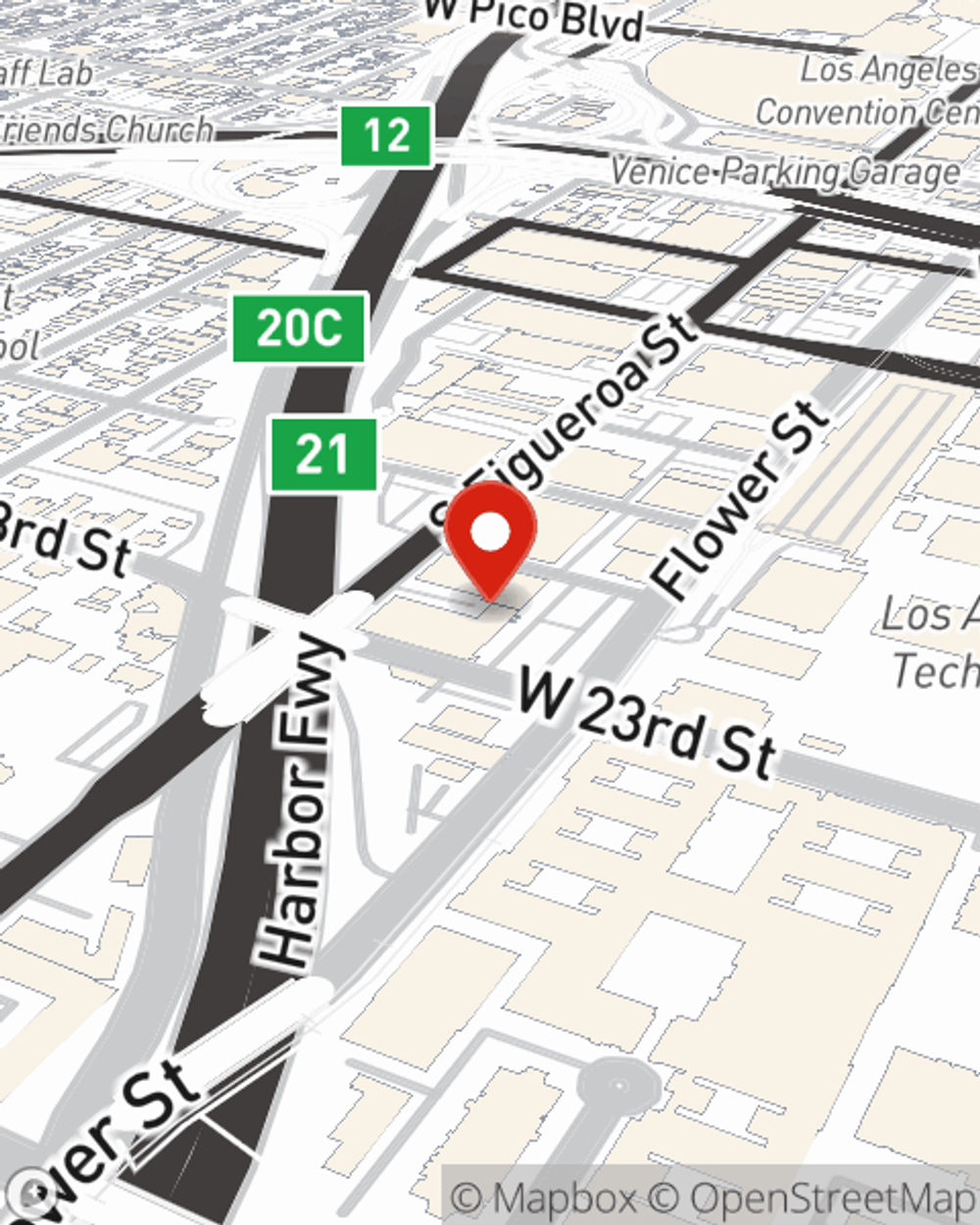

You can kick back with State Farm's Condo Unitowners Insurance knowing you are prepared for the unexpected with excellent coverage that's right for you. State Farm agent Frank Garcia can help you discover all the options, from liability, bundling to replacement costs.

Contact State Farm Agent Frank Garcia today to check out how one of the well known names for condo unitowners insurance can help protect your condominium here in Los Angeles, CA.

Have More Questions About Condo Unitowners Insurance?

Call Frank at (213) 749-4555 or visit our FAQ page.

Simple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Frank Garcia

State Farm® Insurance AgentSimple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.